FINANCIAL INFORMATION AS OF 31 MARCH 2024

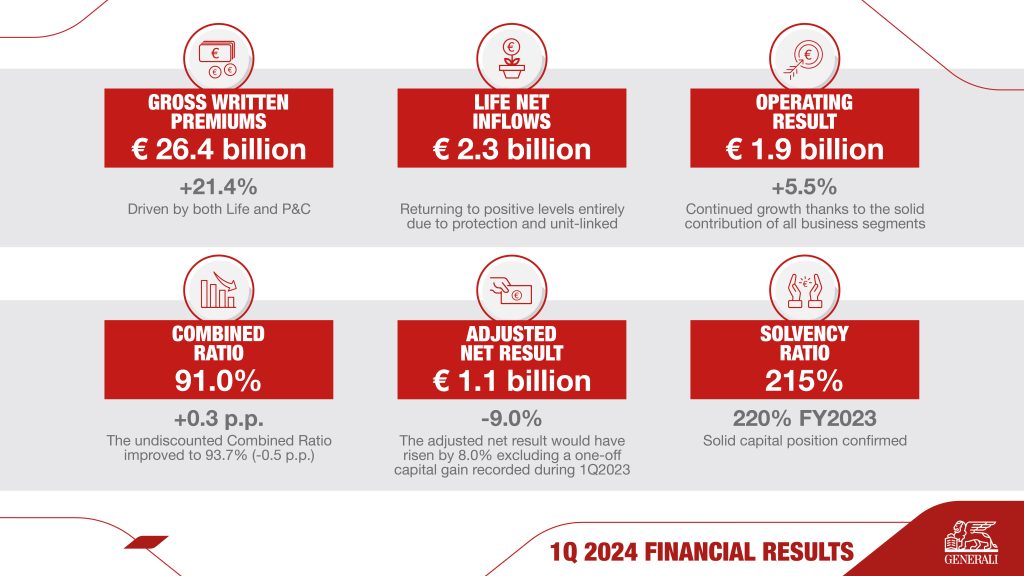

- Gross written premiums increased to € 26.4 billion (+21.4%), driven by both Life and P&C

- Positive Life net inflows at € 2.3 billion entirely thanks to protection and unit-linked and consistent with the Group’s strategy. New Business Value up 5.0%

- Combined Ratio was 91.0% (+0.3 p.p.). The undiscounted Combined Ratio improved to 93.7% (-0.5 p.p.)

- Continued growth in operating result to € 1.9 billion (+5.5%), thanks to the solid contribution of all business segments

- Adjusted net result was € 1.1 billion (-9.0%). The adjusted net result would have risen by 8.0% excluding a one-off capital gain incurred during 1Q2023

- Solid capital position confirmed, with Solvency Ratio at 215% (220% FY2023)

Generali Group CFO, Cristiano Borean, said: “In the first quarter of 2024 Generali delivered continued growth of its operating result, thanks to the solid contribution of all business segments. The Group achieved positive Life net inflows, built on our strategic decision to focus on protection and unit-linked lines and the commercial actions implemented during 2023. The P&C segment also benefits from the consolidation of Liberty Seguros for the first time, an acquisition which is already contributing positively to the Group’s earnings profile. Thanks to our diversified insurance and asset management model and solid capital position, driven by strong normalised capital generation, we remain fully on-track to meet all the targets of our ‘Lifetime Partner 24: Driving Growth’ strategy.”

Discover more on the consolidated results as of 31 March 2024 in the full press release.