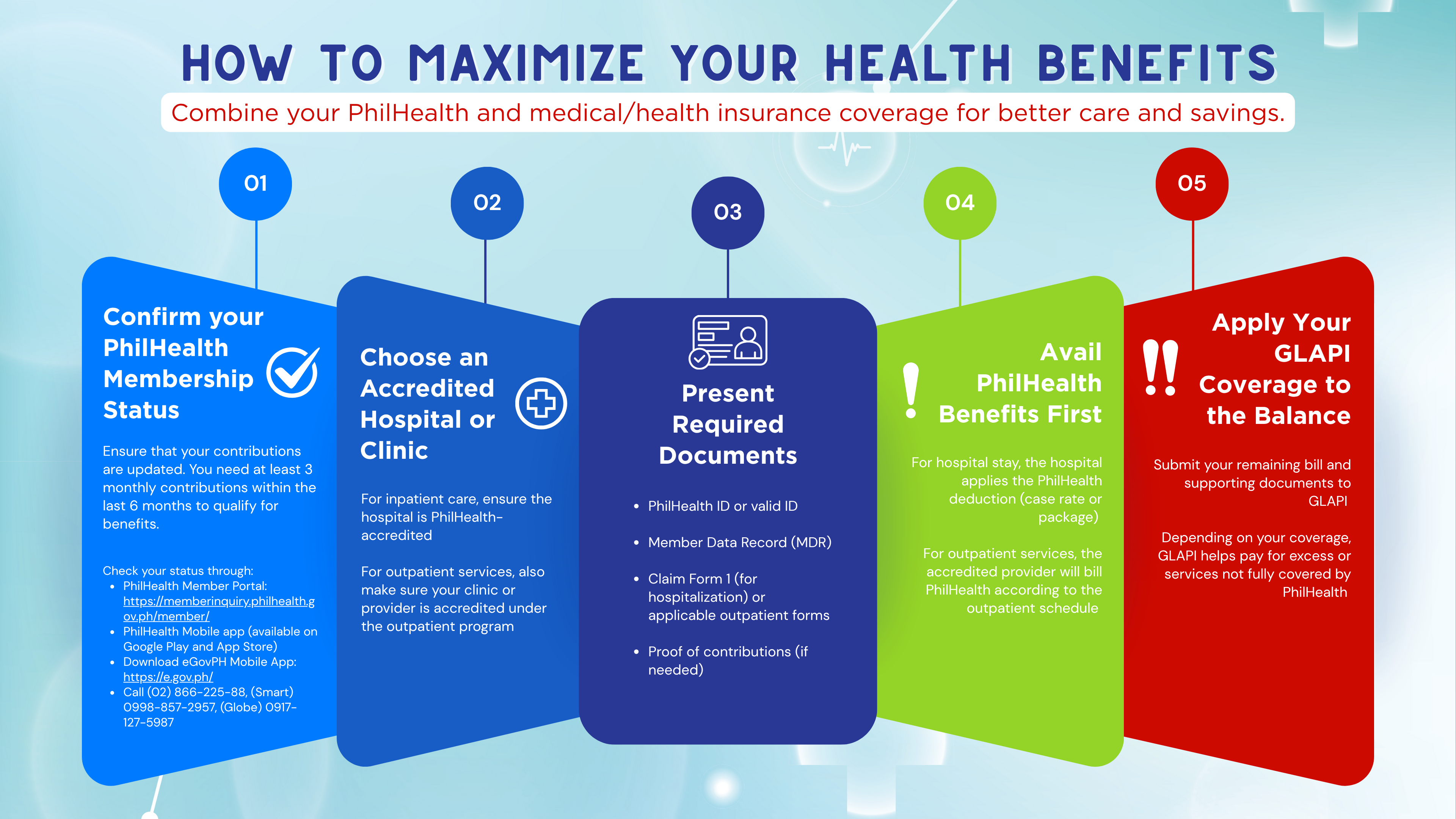

Healthcare expenses can often feel overwhelming. However, you don’t need to rely on a single source of coverage. By combining your PhilHealth benefits with your GLAPI health plan, you can reduce out-of-pocket costs, expand your coverage, and ensure that you and your family are fully protected.

At GLAPI, we want to help you make the most of your healthcare benefits. Here’s everything you need to know.

Why Use PhilHealth with Your Health/Medical Insurance?

PhilHealth is the national health insurance program designed to assist Filipinos with the costs of medical care. Its coverage includes hospitalization, preventive care, inpatient and outpatient services, and special benefit packages for certain major illnesses.

Your GLAPI health plan complements PhilHealth by covering expenses that exceed PhilHealth’s benefit limits, such as specialist fees, higher-tier hospital rooms, follow-up care, and other services that may not be fully covered by PhilHealth.

Together, they provide layered protection: PhilHealth reduces the baseline costs, while GLAPI covers the balance.

PhilHealth’s Outpatient Benefits

As part of ongoing health reforms, PhilHealth now offers Outpatient Benefits, expanding its services beyond hospital confinement. These benefits aim to reduce costs for everyday medical services, many of which are particularly relevant to GLAPI members. Here are some key inclusions:

- Consultation fees with doctors in outpatient settings

- Laboratory tests (e.g., urinalysis, blood sugar tests, complete blood counts)

- X-rays

- Lifestyle counseling, smoking cessation programs, and other preventive interventions

- Day surgeries (elective procedures that do not require overnight admission)

- Mental health services, including consultations and therapy (covered under outpatient benefits)

- Radiotherapy, hemodialysis, and outpatient transfusions

Additionally, the benefits support the Konsulta package, which provides primary care and basic outpatient services.

This means that some of the care you may seek outside of the hospital—such as follow-up visits, lab tests, or mental health therapy—could already be subsidized by PhilHealth before your GLAPI benefits take effect.

Key Things to Remember

- Benefit Caps: PhilHealth inpatient coverage has a 45-day annual limit per member

- Outpatient Benefits: The outpatient benefits (consultations, tests, mental health) have their own tolerance and package limits set by PhilHealth

- Z Benefit Packages: For major illnesses (e.g., certain cancers, kidney transplants), PhilHealth covers a large portion if pre-authorized, while GLAPI can cover costs outside the package.

- No Co-Payment Policy: Accredited facilities must deduct PhilHealth benefits before billing patients

- Keep Receipts and Documents: This will ensure fast and seamless processing when you claim with GLAPI

Your healthcare is too important to underutilize. By combining your PhilHealth entitlements with your GLAPI plan, you not only protect your finances but also ensure that you and your loved ones have comprehensive, reliable support in every situation—from routine checkups to unexpected emergencies.

At GLAPI, we care not only about coverage but also about making your journey to better health easier, smarter, and more secure.

Sources: https://www.philhealth.gov.ph/, Philhealth Outpatient Benefits – Assistance.PH