Financial information at 31 March 2023

Generali delivers strong profitable growth and confirms its extremely solid capital position

The strong profitable growth delivered in the first quarter confirms that Generali remains fully on-track to meet the targets of the ‘Lifetime Partner 24: Driving Growth’ strategy. The performance of the P&C segment reflects the focus on technical excellence, while in the Life segment the Group continues to rebalance the business mix towards more profitable lines, even in a challenging environment. Generali also confirms its extremely solid solvency position, driven by strong organic capital generation.

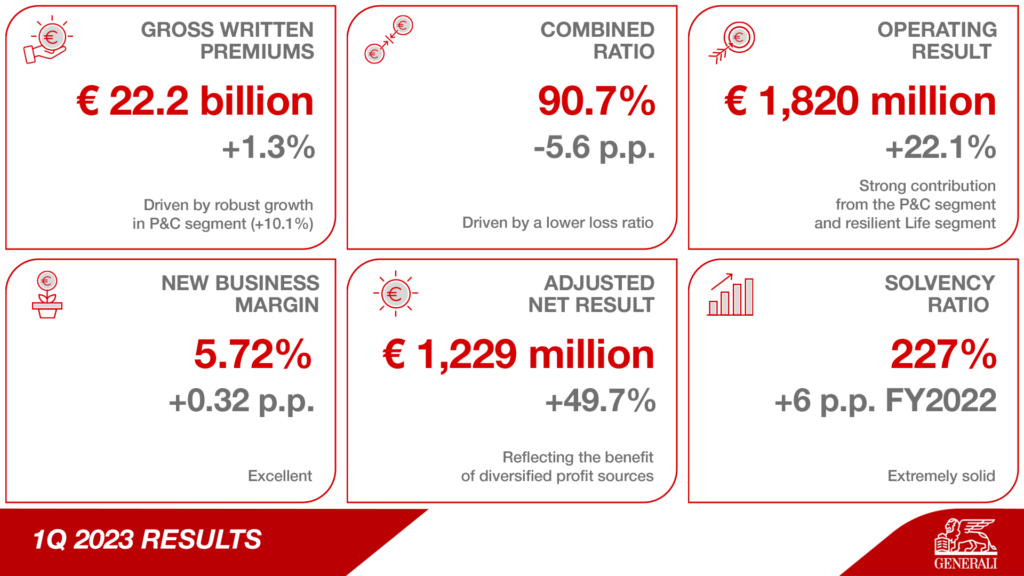

- Gross written premiums increased to € 22.2 billion (+1.3%) driven by robust growth in P&C segment (+10.1%). Life net inflows were entirely focused on unit-linked and protection, consistent with the Group’s strategy

- Operating result rose to € 1,820 million (+22.1%), mainly thanks to the strong contribution from the P&C segment, while the Life segment was resilient. The Combined Ratio improved to 90.7% (-5.6 p.p.). Excellent New Business Margin at 5.72% (+0.32 p.p.)

- Adjusted net result grew substantially to € 1,229 million (+49.7%), reflecting the benefit of diversified profit sources

- Extremely solid Solvency Ratio at 227% (221% FY 2022)

This quarter is also the first time that Generali reports under the new accounting standards. This allows the Company to significantly improve the visibility and predictability of profit sources and provides a more accurate representation of the value embedded in its Life business.

Further information is available in the press release.