PRESS RELEASE

FINANCIAL INFORMATION AT 31 MARCH 20221

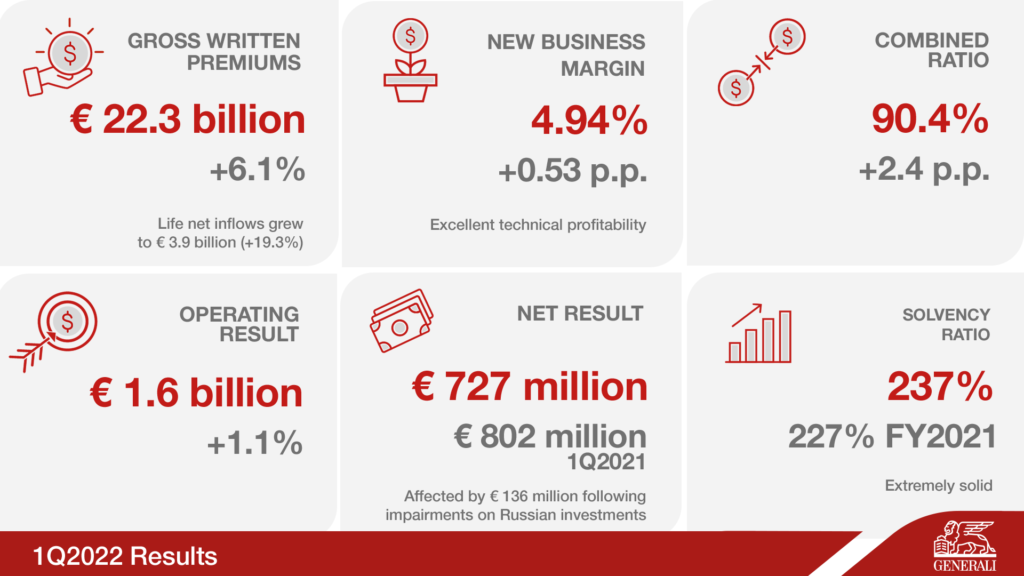

Excellent profitability with growth in premiums and operating result. Extremely solid capital position. Net result affected by impairments on Russian investments.

→ Gross written premiums increased to € 22.3 billion (+6.1%), up in the P&C (+6.4%) and Life (+6%) segments. Life net inflows, entirely focused on the unit-linked and protection lines, grew to € 3.9 billion (+19.3%)

→ Operating result rose to€ 1.6 billion (+1.1%), thanks to the positive performance of the Life, P&C and Holding and other businesses segments. The Combined Ratio was at 90.4% (+2.4 p.p.) and the New Business Margin was excellent at 4.94% (+0.53 p.p.)

→ Net result reached€ 727 million (€ 802 million 1Q2021), affected by impairments on Russian investments amounting to € 136 million. Excluding this impact, the net result would have been € 863million

→ Solvency Ratio remained extremely solid at 237% (227% FY2021)

Generali Group CFO Cristiano Borean commented: “The results for the first quarter confirm the excellent performance of Generali, despite a context characterised by uncertainty due to the conflict in Ukraine. The business development in the most profitable segments demonstrates the Group’s ability to consistently generate value, while maintaining a solid and industry leading capital position. In the first three months of the year, the Group also launched the new strategic plan ‘Lifetime Partner 24: Driving Growth’, focused on strong growth in earnings per share, increased cash generation and higher dividends.

The Group will continue to stand in solidarity and remain close to the people impacted by the conflict in Ukraine, helping them thanks to an emergency donation of € 3 million and a global fundraising campaign carried out by employees and through The Human Safety Net Foundation, to back UNICEF in its efforts to support those suffering due to this war.”

1 Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope); as a result, the contribution of the Cattolica group was neutralised in the calculation for changes on equivalent terms. Changes in the operating result, general account investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison; as a result, they considered the contribution from the Cattolica group in percentage changes.

Read full press release here.